Interest Rates

This resource provides a method to import interest rates of a mortgage provider into the Baufi-Manager.

Loan ranges:

POST /financing/construction/v1.0/provider/{providerId}/loanranges

Base rates:

POST /financing/construction/v1.0/provider/{providerId}/interestrates

Supported media types:

This method can be used to post interest rates for a given provider. There are to ways to configure interest rates: - by usage of base rates (Basisraten) - by providing a list of loan ranges (Darlehensbereiche)

Request

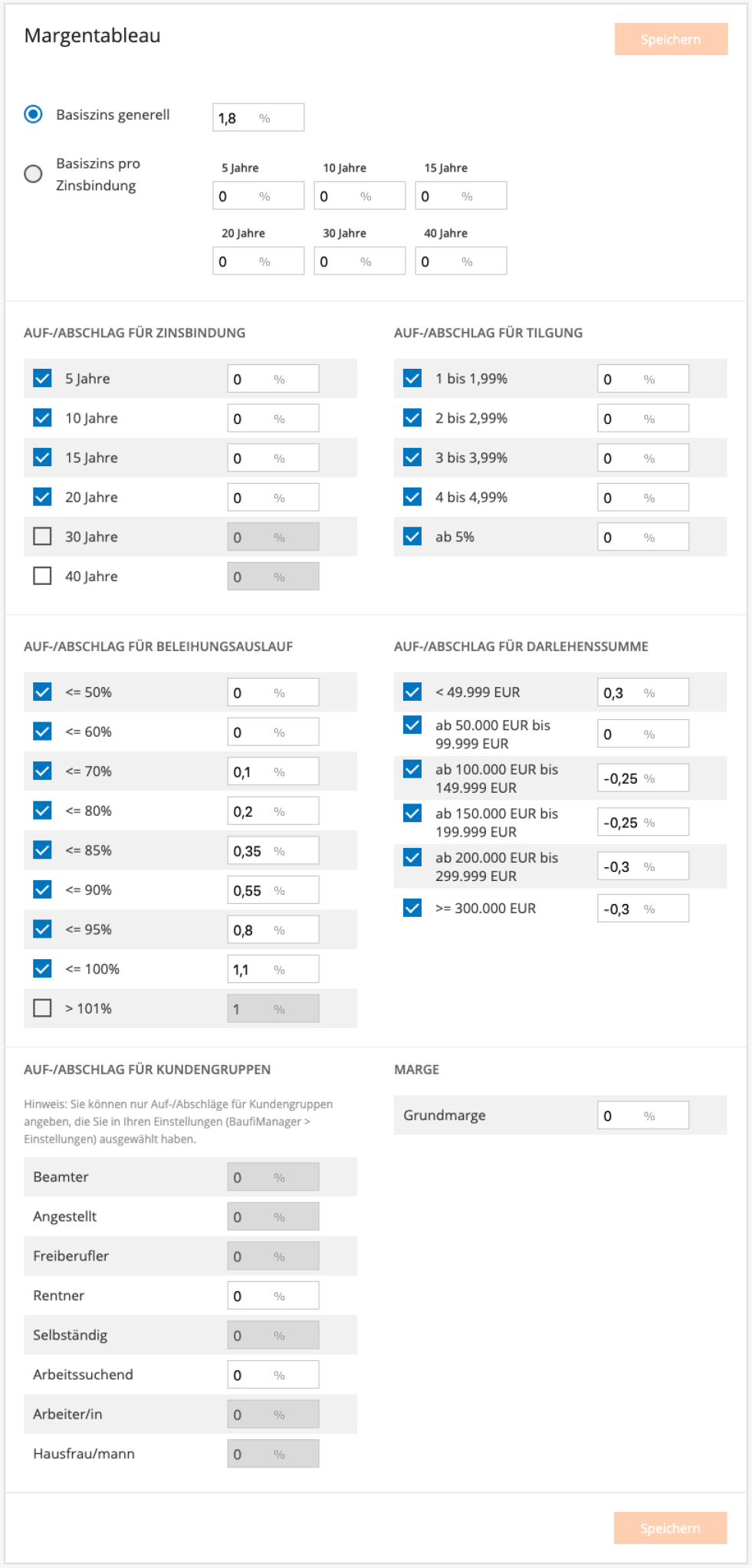

Base rate

Path parameters

| PARAMETER | DESCRIPTION |

|---|---|

| providerId | the id of the mortgage provider |

Query parameters

| parameter | sub parameter | value | description |

|---|---|---|---|

| usingGeneralBaseRate | default true | determines if a general baserate is used or if the baserate depends on the FixedNominalInterestRates | |

| generalBaseRate (Basiszins) | default 0 | ||

| baseRatePerFixedInterestRateSpreads (Basiszins pro Zinsbindung): | need to be provided only when "usingGeneralBaseRate" set to false | ||

| spread | default 0 | the baserate for the given nominal interest rate | |

| fixedNominalInterestRate | FIVE_YEARS, TEN_YEARS, FIFTEEN_YEARS, TWENTY_YEARS, THIRTY_YEARS, FORTY_YEARS | ||

| margin | default 0 | ||

| **interest spreads:** | [fixedInterestRateSpreads, amortisationSpreads, loanToValueRatioSpreads, loanRangeSpreads, employmentSpreads] | Interest spreads are lists of spreads grouped by a certain type. For example the employmentSpreads consist of spreads for certain employments (pensioner, employed...). Each spread object consists of a spread value and an enum value. Some of them also have a flag which indicates if the provider offers loans for the given type. There should be one spread object for each enum type. If some types are missing, default values are set for the missing types. Multiple spreads for the same type result in a status 412. | |

| fixedInterestRateSpreads | |||

| spread (Auf- / Abschlag) | default 0 | the spread value for the given nominal interest rate | |

| enabled | default false | true if the provider should offer loans for the given nominal interest rate | |

| fixedNominalInterestRate | see baseRatePerFixedInterestRateSpreads | ||

| amortisationSpreads (Tilgungsrate) | |||

| spread (Auf- / Abschlag) | default 0 | the spread value for the given amortisation rate | |

| enabled | default false | true if the provider should offer loans for the given amortization rate | |

| amortizationRange | AMORTISATION_ONE_TO_TWO (1-1,99%), AMORTISATION_TWO_TO_THREE (2-2,99%), AMORTISATION_THREE_TO_FOUR (3-3,99%), AMORTISATION_FOUR_TO_FIVE (4-4,99%), AMORTISATION_FIVE_AND_ABOVE (>=5%) | ||

| loanToValueRatioSpreads (Beleihungsauslauf) | |||

| spread (Auf- / Abschlag) | default 0 | the spread value for the given loan to value ratio | |

| enabled | default false | true if the provider should offer loans for the given loan to value ratio | |

| lanToValueRatioRange | UNTIL_FIFTY (<=50%), ABOVE_FIFTY_TO_SIXTY (<=60%), ABOVE_SIXTY_TO_SEVENTY (<=70%), ABOVE_SEVENTY_TO_EIGHTY (<=80%), ABOVE_EIGHTY_TO_EIGHTY_FIVE (<=85%), ABOVE_EIGHTY_FIVE_TO_NINETY (<=90%), ABOVE_NINETY_TO_NINETY_FIVE (<=95%), ABOVE_NINETY_FIVE_TO_HUNDRED (<=100%), ABOVE_HUNDRED (>100%) | ||

| loanRangeSpreads (Darlehenssumme) | |||

| spread (Auf- / Abschlag) | default 0 | the spread value for the given loan range | |

| enabled | default false | true if the provider should offer loans for the given loan range | |

| baseRateloanRange | BELOW_50000 (< 50000€), FROM_50000_TO_BELOW_100000 (< 100000€), FROM_100000_TO_BELOW_150000 (< 150000€), FROM_150000_TO_BELOW_200000 (< 200000€), FROM_200000_TO_BELOW_300000 (< 300000€), FROM_300000_AND_ABOVE (>= 300000€) | ||

| employmentSpreads (Kundengruppe) | |||

| spread (Auf- / Abschlag) | default 0 | the spread value for the given employment type | |

| employment | CIVIL_SERVANT (Beamter), EMPLOYED (Angestellt), FREELANCER (Freiberufler), PENSIONER (Rentner), SELFEMPLOYED (Selbständig) |

JSON:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 | |

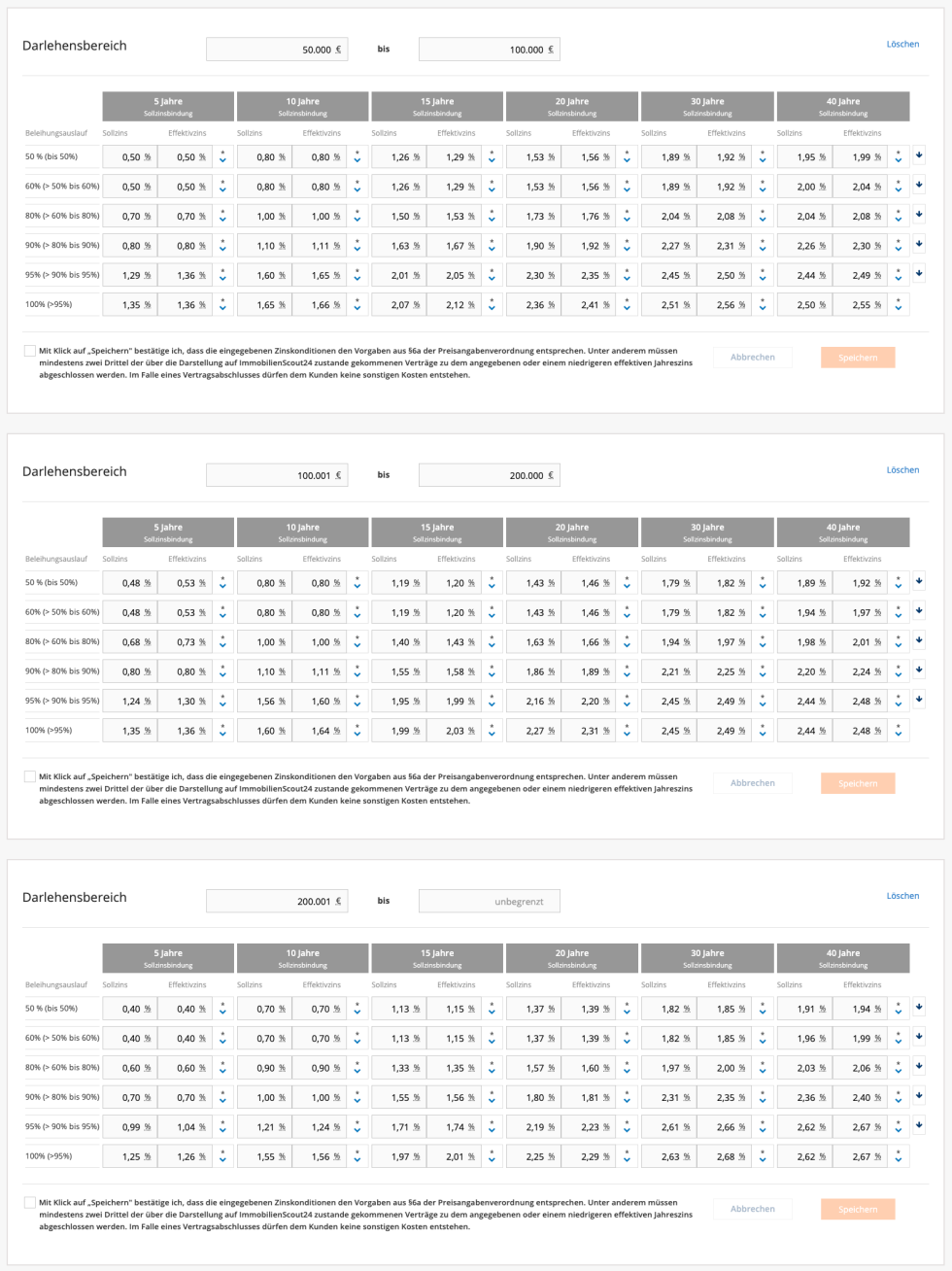

Loan Ranges

Query parameters

| parameter | value | description |

|---|---|---|

| minimumLoanAmount | default 0 | |

| maximumLoanAmount | UNTIL_FIFTY, ABOVE_FIFTY_TO_SIXTY, ABOVE_SIXTY_TO_EIGHTY, ABOVE_EIGHTY_TO_NINETY, ABOVE_NINETY_TO_NINETY_FIVE, ABOVE_NINETY_FIVE | a loan Range with no maximumLoanAmount will result in a range [minimumLoanAmount to infinity) Besides that a loanRange contains a list of interest tuple. An interestTuple defines the nominal and effective interest rates for a combination of loanToValueRatio (Beleihungsauslauf) and fixedNominalInterestRate (Sollzinsbindung). Each combination can only be configured once. Otherwise a 412 status code is returned. (see the picture which shows a loan range in theBaufimanager) |

| fixedNominalInterestRate | FIVE_YEARS, TEN_YEARS, FIFTEEN_YEARS, TWENTY_YEARS, THIRTY_YEARS, FORTY_YEARS |

JSON:

1 2 3 4 5 6 7 8 9 10 11 12 13 14 | |

Response

Screenshot of Base Rate

Screenshot of Loan Ranges